Billing for in-house blood draws or using venipuncture isn’t just about accurate lab billing codes.

It’s about compliance with federal and payer-specific regulations like HIPAA.

Keep in mind, venipuncture is always billed in-house or sent out to labs for the collection of venous blood.

According to CMS guidelines and the AMA, a provider or practice may only bill for a service they directly perform.

Billing for services outside your lab is a fraudulent activity.

This guide explores how to bill insurance for in-house blood draws and how to avoid costly lab billing mistakes.

How to Bill Insurance for In-House Blood Draws?

Here are the key steps to bill the insurance for in-house blood draws.

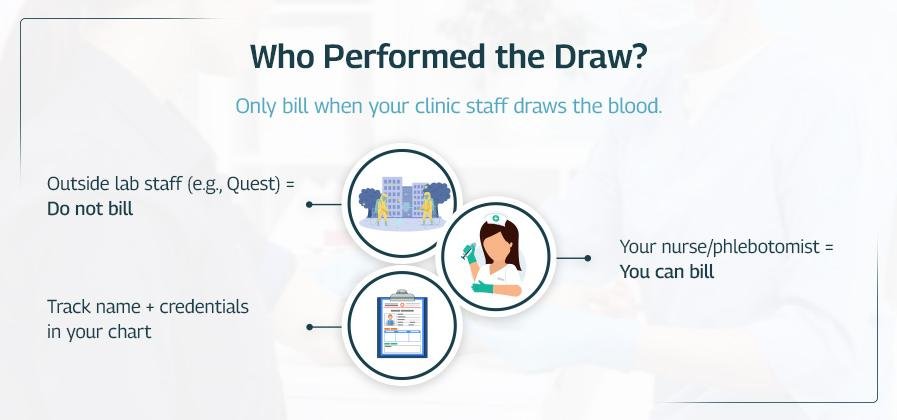

Ensure Who Performed the Blood Draw?

The question here is who performed the blood draw?

Remember, you can only bill the blood test that you take within your lab.

If a contracted lab’s personnel draws blood, then you can’t bill the blood draw.

According to CMS and the AMA, billing for a service you did not perform is considered fraudulent.

CMS (Pub. 100-04, Chapter 16, §60.1): “A provider or supplier must furnish the service to bill for it.”

💡 Best Practice: Always include the phlebotomist or your staff member who takes blood samples.

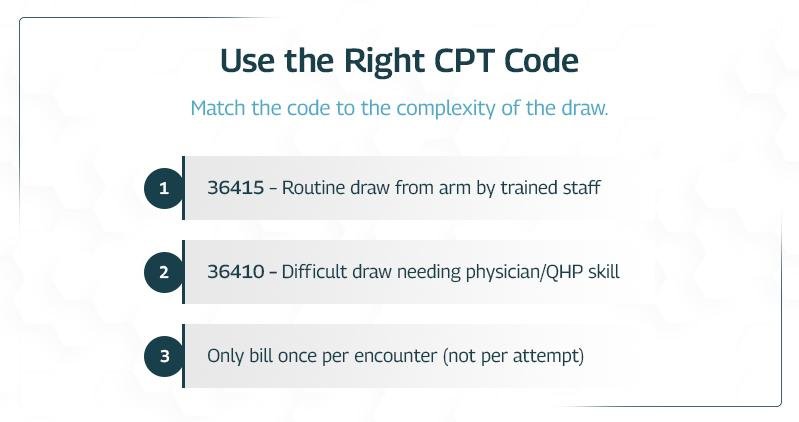

Use the Right CPT Code

When billing for blood draws, choosing the correct CPT code is crucial.

There are two main codes to know: CPT 36415 and CPT 36410.

While they both relate to venipuncture, they apply to different situations.

Using the wrong one can lead to denied claims or compliance issues, so it’s essential to understand when to use each.

Use CPT 36415 for Routine Blood Draws

Lab owners must use this for standard blood draws.

You should use CPT 36415 when:

- Blood is drawn from a vein in the arm or hand

- The draw is routine and uncomplicated

- It’s performed by trained staff like a:

- Phlebotomist

- Nurse

- Medical assistant (MA)

Bill this code only once per patient visit. No matter how many tubes you collect or sticks you perform.

According to CMS (MLN Matters MM5347):

Report only one unit of CPT 36415 per patient encounter, even if you collect multiple specimens.

Use CPT 36410 for Difficult or Physician-Performed Draws

This code is for more complex venipunctures that require a physician’s skill.

Use CPT 36410 when:

- The draw is not routine

- A physician or qualified healthcare provider (QHP) performs the draw

- The draw is from a more challenging site, such as:

- Jugular vein

- Femoral vein

- Subclavian vein

- Staff attempts have failed, and a higher level of skill is needed

Because this procedure is more advanced, medical necessity must be documented.

You must also report ICD-10 diagnosis codes that explain why the complex draw was necessary.

Common ICD-10 codes that support CPT 36410:

- I87.8 – Other specified venous disorders

- I99.8 – Other circulatory system disorders

- R68.89 – Other general symptoms and signs

CMS (LCD L34049) emphasizes that CPT 36410 must be justified with appropriate documentation and used only when the complexity warrants it.

Important Reminders:

- Never bill both 36415 and 36410 for the same encounter. Choose one.

- Do not use 36410 to increase reimbursement or for routine blood draws. It must be:

- Medically necessary

- Documented in the medical record.

Link the Right ICD-10 Code

Choosing the proper CPT code tells the payer what service you performed—like a routine blood draw or a complex venipuncture.

But that’s only half the picture. You also need an ICD-10 code to explain the reason for the procedure.

Without a valid, medically necessary diagnosis, the claim can be denied—even if the CPT code is correct.

Every blood draw, even routine ones, must link to a diagnosis that justifies the lab tests.

Moreover, the diagnosis code should reflect the clinical reason for ordering the labs, not just the blood draw or a vague complaint.

Common ICD-10 Codes for Routine Lab Work

Here are a few examples of diagnosis codes often used to support routine lab draws:

- Z00.00 – Routine adult check-up without abnormal findings

- E11.9 – Type 2 diabetes without complications

- R79.89 – Other abnormal findings of blood chemistry

These are commonly used when blood tests are part of regular monitoring or health screenings.

For example, Z00.00 might apply during an annual physical, and E11.9 might support labs ordered to monitor a diabetic patient’s blood sugar.

According to CMS, Medicare requires that the ICD-10 code support the necessity of the lab test, not just the draw itself. That means the diagnosis you submit shows the reasons for the test. For example, if you ordered a CBC to check for anemia, the ICD-10 code should relate to symptoms or conditions like fatigue or blood loss, not just the act of drawing blood.

Always make sure your ICD-10 code lines up with the reason for the lab test, not just the venipuncture. This helps ensure your claim shows apparent medical necessity and avoids rejections from Medicare or other payers.

Bill the Lab Test (Only If You Performed It)

After drawing a patient’s blood, the next question to ask is simple:

Did your office or clinic perform the lab test on-site?

If the answer is yes, then you can bill for the lab test in addition to the blood draw. In that case, make sure to use the correct CPT code for the specific test performed.

Example:

- 85025 – Complete Blood Count (CBC), automated, with differential

But if your office didn’t perform the test, it indicates you just collected the sample and sent it to an external lab (like LabCorp or Quest).

In this case, you should not bill for the lab test.

As discussed above, you can only bill for the services your office provided to the patient.

So, you will bill only the blood draw, using a code like 36415.

Compliance Reminder: According to the AAPC, billing for a lab test you didn’t perform is considered “pass-through billing.” This practice is risky. It may violate anti-kickback laws and false claims regulations. It’s not just a billing mistake; it could trigger legal or financial penalties.

Use Modifiers If You Also Did an Office Visit

If you saw the patient for a medical visit and also drew blood during the same encounter, use:

- 99213-25 – For the E/M visit

- 36415 – For the blood draw

Modifier 25 tells the insurer that the office visit was separate and significant, not just a quick stop for lab work.

The act of drawing blood (36415) is usually considered incidental to the lab test itself, and the modifier is applied to the test if a separate E/M service was also performed.

If the blood draw is the only service provided on that day, no modifier is needed.

Medicare Reminder:

Without Modifier 25, many payers (especially Medicare) will deny or bundle 36415 into the E/M visit.

If a patient comes in for a blood draw and also receives a separate, significant E/M service (e.g., a doctor assesses the patient’s symptoms and decides on the need for the blood test), you would bill:

- 36415 (venipuncture)

- The appropriate laboratory test code (e.g., 80053 for a comprehensive metabolic panel)

- Modifier 25 on the E/M service code.

Other relevant modifiers:

- 59: This modifier indicates that the procedure or service was distinct or independent from other services performed on the same day.

- 90: This modifier shows a lab test is sent to an outside (reference) lab.

- 91: This modifier indicates a repeat clinical diagnostic laboratory test.

- 92: This modifier is used when a test is performed using a non-standard method or platform.

Know How Payers Reimburse

Payer policies vary a lot, especially around lab draws.

Here’s what to expect:

- Medicare: Pays ~$3–$5 for 36415

- Often bundles it unless Modifier 25 is used appropriately

- Requires medical necessity for lab tests, not just routine screening

- Medicaid:

- Varies by state, but most follow Medicare policy

- Some require specific lab panels to be ordered for 36415 to be reimbursed

- Commercial Insurance:

- May reimburse at higher rates, or not at all if the visit is bundled

- Always review each payer’s provider manual or fee schedule

Document Everything

Documentation is your first line of defense in case of audits or claim denials.

So, don’t skimp here.

Always check payer-specific bundling edits and CCI edits (Correct Coding Initiative) before billing.

Document everything properly while blood draws.

Your chart must include:

- A signed lab order from the provider

- A clear clinical indication for the lab (ICD-10 reason)

- The name of each test ordered

- The staff member’s name and credentials who performed the draw

- The time and date of the draw

Common Mistakes to Avoid when Billing Insurance for In-House Blood Draws

Even small billing mistakes can cause headaches like denials, delays, or lost revenue.

Let’s make sure you avoid the common ones.

Here’s what to watch for:

Don’t bill 36415 more than once per visit

Even if you draw five tubes, you still only bill one unit of 36415.

One draw = one charge, no matter how much blood you take.

Don’t bill if the lab drew the blood

If the lab (like Quest or LabCorp) sends its phlebotomist to your office, they bill for it, not you.

Only bill if your staff did the draw.

Don’t forget the diagnosis code.

Insurance needs to know the actual reason for the lab tests.

If you skip the diagnosis (ICD-10) code or pick the wrong one, your claim will likely get denied.

Always match your ICD-10 code to the reason for the lab.

Don’t skip the provider’s lab order.

You must have a provider’s signed order in the patient’s chart.

Remember, without it, your documentation is incomplete, even if the draw happened.

No order = no payment (and potential audit trouble).

Don’t guess, be specific and accurate

Be accurate. Document the exact tests ordered and collected. Don’t just write “labs.”

Use test names like “CBC,” “Lipid Panel,” or “A1C” in your notes.

Double-Check Before You Submit

Before you send the claim, run through a quick checklist:

- Does your staff do the draw?

- Is 36415 only listed once?

- Are the diagnosis codes correct and medically necessary?

- Is the provider order documented?

- Are the lab tests listed in the chart?

One small error can cause a denial or delay in payment.

Final Thoughts

Billing for in-house blood draws isn’t tricky.

But you do need to follow the rules.

A few small mistakes can lead to claim denials, payment delays, or even compliance issues.

The good news? If you stick to the basics, you’ll get it right most of the time.

Here’s a quick checklist to keep you on track:

- Only bill for the blood draw if your staff performed it.

- Use CPT 36415, but just once per patient visit, regardless of the number of samples or sticks.

- Link the draw to a medically necessary diagnosis using the correct ICD-10 code.

- Add Modifier 25 if the draw happened during an office visit with a separately billable evaluation.

- Document everything clearly (especially if the draw was complex or medically justified).

Get these basics right, and you’ll reduce billing errors, avoid rejections, and speed up your payments.